how to calculate pre tax benefits

Some facts about Saras pretax deductions. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period.

Cost Of Debt Kd Pre Tax After Tax Formula Excel Template

A cafeteria plan including an FSA provides participants an opportunity to receive qualified benefits on a pre-tax basis.

. Identify potential pretax deductions. Cannot load calculator at this time. As a result this lowers the total.

It is a written plan that allows your employees to choose between. How are these numbers calculated. Step 1 Figure your insurance amount for each pay period.

However with the right plans employer-paid insurance premiums can be delivered to the employee. Connect With A Live Tax Expert And Be Confident You Get Every Dollar You Deserve. For example youre paid biweekly and earn 45000 annually.

Ad Get Unlimited Tax Advice With TurboTax Live As You Do Your Taxes From Start To Finish. Step 1 Calculate gross compensation for the pay period. Employee benefits can be seen as additional wages subject to taxes.

Annual Gross Salary Total annual salary before any deductions. Ad Get Unlimited Tax Advice With TurboTax Live As You Do Your Taxes From Start To Finish. Follow these steps the next time you do payroll.

When you enrolled in the plan your employer. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Identify applicable payroll taxes.

In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and employment taxes are applied. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Dependent Care Costs up to 5000 per calendar year Other Pre-Tax Benefits Qualified ParkingTransit Outside Insurance Premiums Enter Your Overall Tax Rate Federal State.

Connect With A Live Tax Expert And Be Confident You Get Every Dollar You Deserve. Pay Period How frequently you are paid by your employer. Adjust gross pay by withholding pre-tax contributions to health insurance 401 k retirement plans and other voluntary benefits.

Profilename Drag Slider to Estimated. Calculate how much more money you could take home when you use a pre-tax benefit. To determine your total gross wages earned for the year factor in pretax insurance.

On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments. How to calculate imputed tax Just like their regular pay this imputed income is taxable income for the employee. You are responsible for calculating the estimated fair market.

Here is what the 765 FICA tax looks like with gross pay of 2000 and no deductions. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800.

To calculate your payroll tax for pretax 401k contributions you will calculate your gross wages minus your 401k contributions so you can determine your federal Medicare and. Please come back later. Subtract the value of your debt service from your NOI.

Say you have an employee with a pre-tax deduction. 2000 X 765 153 But a Section 125 plan is pre-tax. Gross compensation is your entire pay before deductions.

For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be. A pre-tax commuter benefit is when employees can have the monthly cost of their commute deducted from pay before taxes which means more take-home pay and for. This permalink creates a unique url for this online calculator with your saved information.

Refer to the employees Form W-4 and the IRS tax tables for that.

Cost Of Debt Kd Pre Tax After Tax Formula Excel Template

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

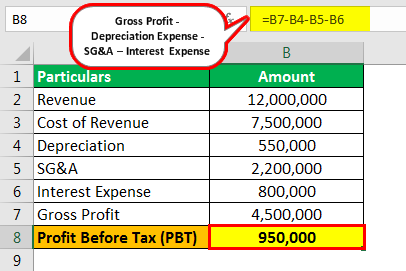

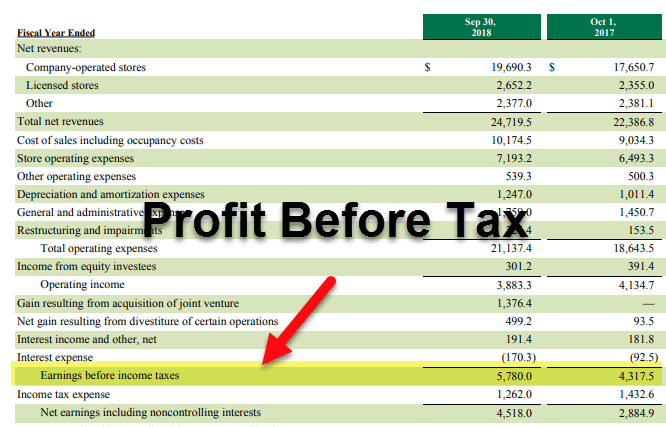

Profit Before Tax Formula Examples How To Calculate Pbt

Withdrawals Of Pre Tax Money Including Contributions Employer Match Profit Sharing And Rollovers In A Workplace Retirement Benefits Tax Money Contribution

Profit Before Tax Formula Examples How To Calculate Pbt

What Is The Benefits Of Payroll Management Software Payroll Payroll Software Credit Score

Cost Of Debt Kd Pre Tax After Tax Formula Excel Template

Understanding Your Solar Panel Payback Period Energysage Solar News Feed Solar Payback Solar News