south carolina inheritance tax 2021

South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of. Estate planning in South Carolina Once you own a sufficient property that exceeds the 1206 million federal estate tax exemption bar you may want to reduce the taxable part of your estate to preserve your heirs.

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

South Carolina does not levy an estate or inheritance tax.

. There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be. South Carolinas 2021 Tax Free Weekend Kicks Off On Friday August 6. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away.

South carolina inheritance tax. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. South carolina does not levy an estate or inheritance tax.

INCREASE IN SOUTH CAROLINA DEPENDENT EXEMPTION line w of the SC1040 The South Carolina dependent exemption amount for 2021 is 4300 and is allowed for each eligible dependent including both qualifying children and qualifying relatives. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket.

South carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates. Ad Get the Personal Advice You Need To Start Planning A Living Trust. For deaths that occur.

You should also keep in mind that some of your property wont technically be a part of your estate. Dont Know How To Start Filing Your Taxes. For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax exemption is 5340000 he would have 4340000 of unused.

On june 16 2021 the governor signed sf 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning january 1 2021 through december 31 2024 and results in the repeal of the inheritance tax as of january 1 2025. HMRC has recently released figures showing that they collected a record 55 billion from Inheritance Tax receipts between April 2021 and February 2022 an increase of 07 billion on the previous year. Learn How to Create a Trust Fund with a Free Wells Fargo Estate Planning Checklist.

There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it. What are the inheritance laws in South. Free tax preparation providers in South Carolina.

However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. This doesnt eliminate other expenses related to estate planning expenses such as inheritance tax that might come from another state or a federal estate tax. South Carolina does not assess an inheritance tax nor does it impose a gift tax.

Very few people now have to pay these taxes. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state.

Not all estates must file a federal estate tax return Form 706. Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000.

April 14 2021 by clickgiant. Unlike some other states there are no inheritance or estate taxes in South Carolina. Ive got more good news for you.

Connect With An Expert For Unlimited Advice. The effective state and local tax rate for south carolina residents in 2019 was 89 percent the 11th lowest percentage among the 50 states according to a new ranking published by the tax foundation. While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds for example in 2021 the federal estate tax exemption amount is 117 million for an individual receipt of an inheritance does not result in taxable income for federal or state income tax.

South Carolina laws preserve the inheritance rights to at least a part of an estate for a surviving spouse even in such cases.

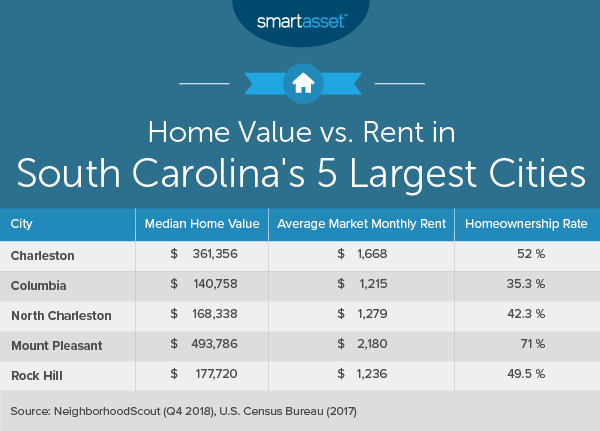

South Carolina Inheritance Laws What You Should Know Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

South Carolina Inheritance Laws King Law

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Carolina Retirement Tax Friendliness Smartasset

South Carolina Income Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Real Estate Property Tax Data Charleston County Economic Development

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

Bernard Arnault Billionaire Millionaire Quotes Millionaire Quotes Quotes Billionaire

South Carolina Estate Tax Everything You Need To Know Smartasset

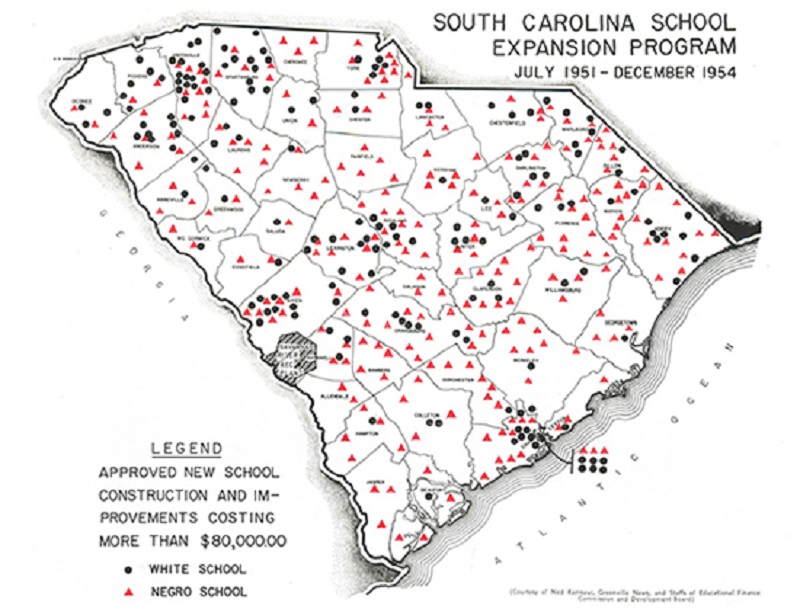

Separate But Equal South Carolina S Fight Over School Segregation Teaching With Historic Places U S National Park Service