st louis county sales tax pool cities

Taxes are billed on November 1 and are due and payable on or before December 31 to the St. Louis County cities which were incorporated after March 19 1984 or areas annexed after March 19 1984 are automatically included in the sales tax pool under State law with no option.

Make A Big Splash At These St Louis Pools And Water Parks Go Magazine S Summer Fun Guide Stltoday Com

The Missouri state sales tax rate is currently.

. The St Louis County sales tax rate is. The county and Chesterfield are numbered among the pool entities. The median assessed value of the property in majority White districts is 181899student compared to 97751 in majority Black districts.

Louis County is put into the pool which then goes into the countys coffers. Louis County cities a bigger share of the sales tax revenue collected within. This map shows roads in St.

This is the total of state and county sales tax rates. Ad Lookup Sales Tax Rates For Free. We have a sales tax pool for a portion of sales taxes in St.

JEFFERSON CITY Certain cities in St. The 2018 United States Supreme Court decision in South Dakota v. 44 rows The St Louis County Sales Tax is 2263.

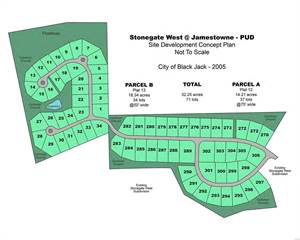

Most point-of-sale cities such as Des Peres have major shopping centers. For these reasons the B cities and the County pool all of the one cent sales tax revenue. Under the system the wealthiest A cities are required to share a portion of their 1-cent countywide sales tax revenues with both the B cities and St.

Nixon previously had vetoed the state Senate version of the legislation. They keep most of the sales taxes collected within their boundaries but submit a portion to the pool. Pool cities by contrast share all the sales taxes they collect with other members of the pool.

Sales Tax Rate University Citys current sales rate is 9238. Louis County and many of the cities throughout St. Louis Countys sales tax allocation and allows some cities like Chesterfield to keep more of the revenue that they generate into the tax pool.

BALLWIN MO KTVI During Monday nights Ballwin alderman meeting officials voted and passed bill 38-71 for attorney John Hessel to. Pool City University City is designated as a pool city which means that it. Jay Nixon on July 1 signed into law the state House version of legislation that changes St.

Louis County is in the. Louis County city range from 800000 to near 2 million the city says all revenue raised through this use tax would stay in Chesterfield. Questions regarding public infrastructure damage from government agencies can be directed to Emergency Operations Manager Dewey Johnson at 218-726-2936.

The 1 sales tax generated in each pool city goes into a collective pool and is then distributed to all pool cities according to population. Louis County generally do not have large revenue producing facilities with some exceptions. JEFFERSON CITY The Missouri Legislature on Thursday approved giving Chesterfield and some other retail-rich St.

A county-wide sales tax rate of 2263 is. Louis County have voted to adopt the St. Louis County County sales tax.

Louis County sales tax rate is 3388 which is made up of a transportation sales tax 05 a mass transit sales tax for Metrolink 025 an additional mass transit sales tax 05 a Regional Parks and Trails sales tax 0288 a childrens trust fund sales tax 025 an emergency communication sales tax 01 a county law enforcement sales tax 05 plus a. Pursuant to section 92840 of the Missouri Revised Statutes the successful bidder should wait at least two 2 weeks after the sale and then must file with Division 29 in the Circuit Court of the City of St. Pool cities by.

Interactive Tax Map Unlimited Use. 1 2012 - Now that the cities in St. Cities in Saint Louis County are either point-of-sale or pool cities.

The minimum combined 2022 sales tax rate for St Louis County Missouri is. They keep most of the sales taxes collected within their boundaries but submit a portion to the pool. Thats because any sales tax thats generated in unincorporated St.

For complete tax information visit St. The pool or B cities which includes all unincorporated areas of St. Their large population may result in lesser per capita sales.

Louis a motion to confirm the sale of property and must have the appraiser at the confirmation hearing to testify to the reasonable value. Brentwood Clayton Crestwood Des Peres Fenton Kirkwood Richmond Heights and St. Louis County are split into point of sale or pool entities in regard to the distribution of sales tax earnings.

Louis County that are maintained by our Public Works or Land Minerals. They include but are not limited to. Louis Countys Department of Revenue.

This is partly because of the vast difference in property wealth in our region. At a time when municipal services are being threatened by budget cuts the outdated system for sharing sales tax revenue in St. Lets consider a property tax pool for schools.

Louis County will get to keep more of the sales tax revenue they generate under a bill signed Friday by Gov. Some of the cities that are currently in. The City of Chesterfield receives a share of the county-wide 1 tax on retail sales through a pool comprised of unincorporated St.

While estimates of what passage could mean for the west St. Louis County on a. Completed forms should be emailed to johnsondstlouiscountymngov.

Under the law each municipality and unincorporated St. This article first appeared in the St. Louis County Department of Revenue.

Most point-of-sale cities such as Des Peres have major shopping centers.

Luxury Hotel St Louis Mo The Ritz Carlton St Louis

The 10 Closest Hotels To Ameristar Casino St Charles Saint Charles

St Louis County Mo Farms For Sale Point2

Drury Plaza Hotel St Louis At The Arch St Louis Mo 2 South 4th 63102

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 138 And Get 33 Off

Mansion House Apartments Saint Louis Mo Apartments Com

2022 Best Places To Live In St Louis County Mo Niche

Drury Inn St Louis At Union Station Pool Pictures Reviews Tripadvisor

Which Are The Most Dangerous Places In Saint Louis Quora

Oyo Hotel St Louis Downtown City Center Mo Pool Pictures Reviews Tripadvisor

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 138 And Get 33 Off

Hotel Saint Louis Autograph Collection Pool Pictures Reviews Tripadvisor

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl